A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

Frequently Asked Questions about IARC Offshore Retirement Plan Rule Changes Sent via email on 16 August 2016 Dear IARC Retiremen

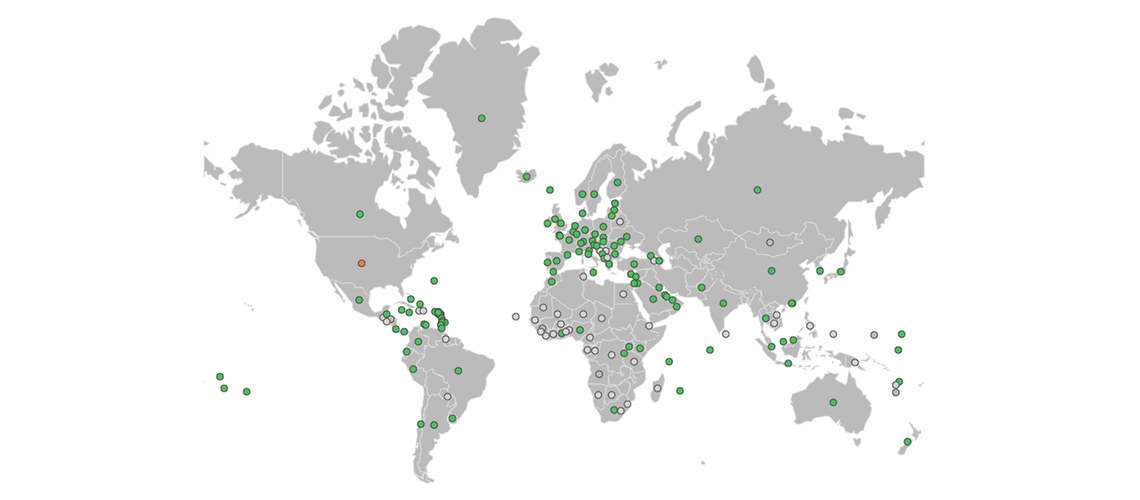

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations

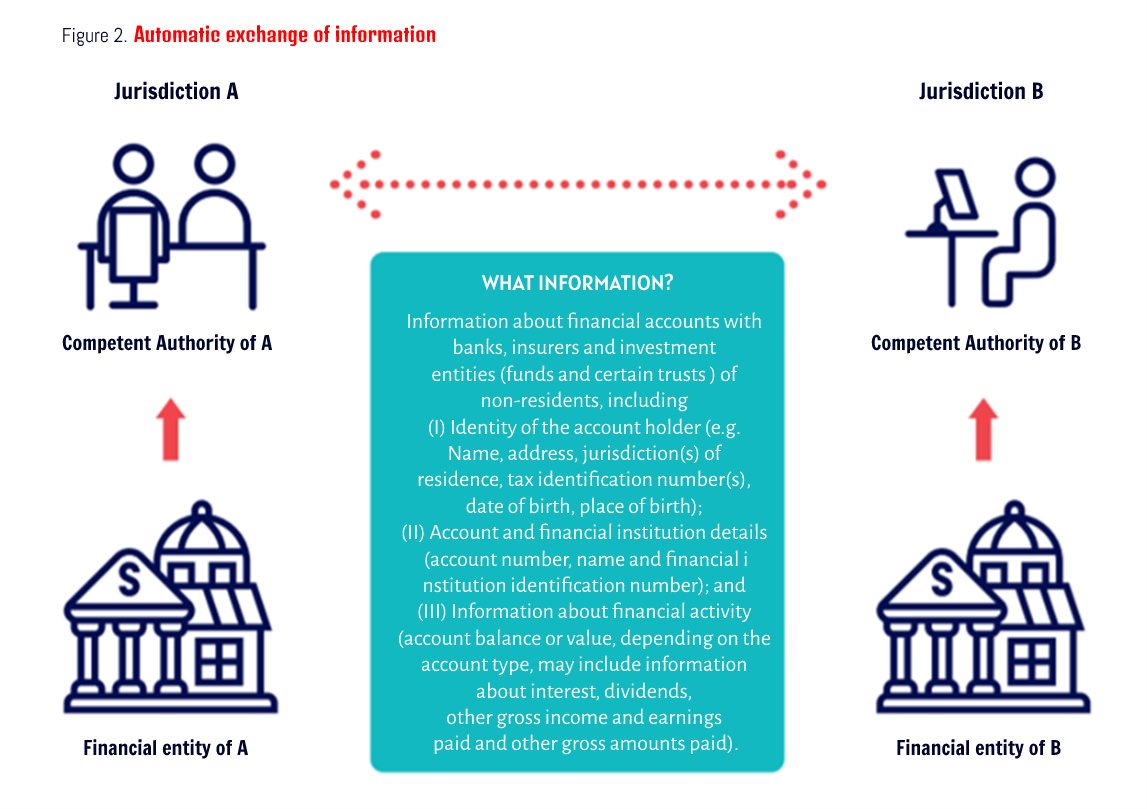

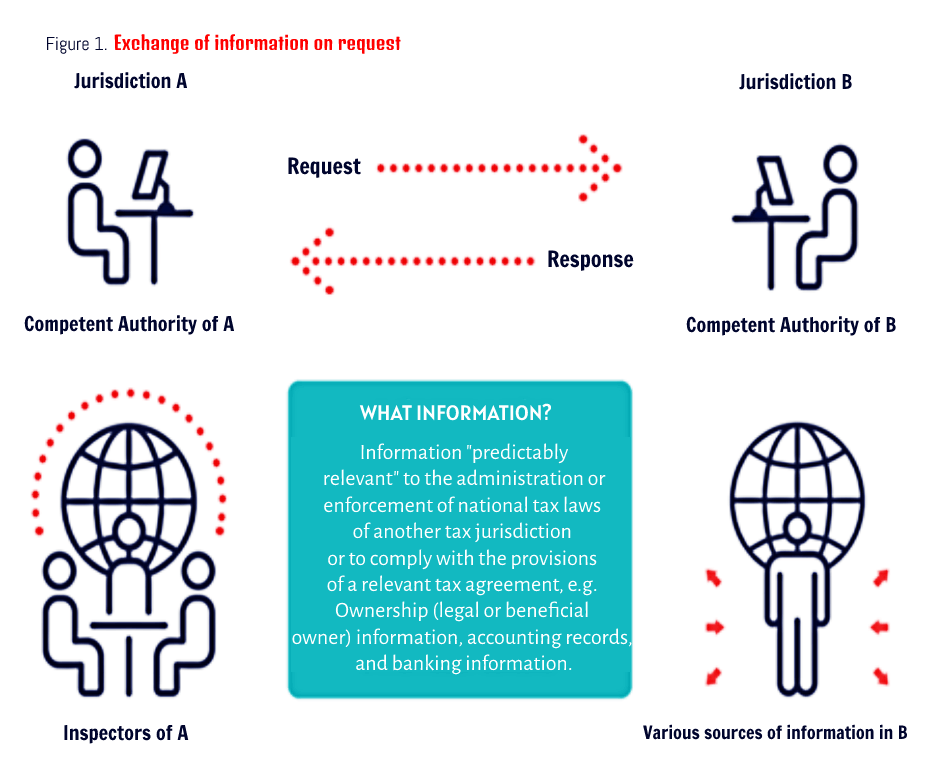

Automatic Exchange of Information: Guide on Promoting and Assessing Compliance by Financial Institutions - OECD

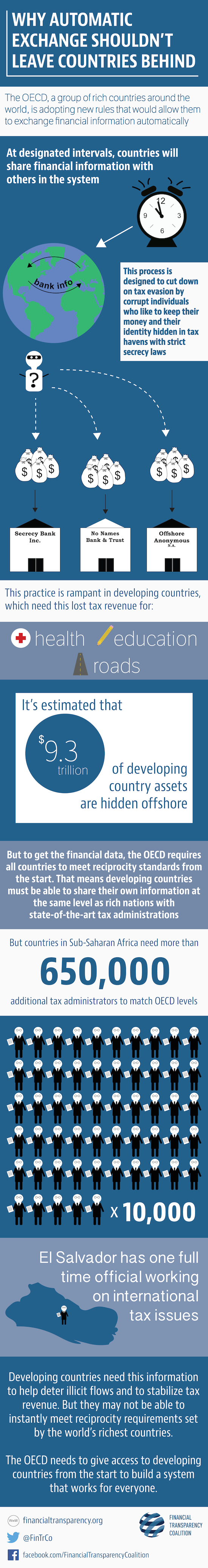

INFOGRAPHIC: Automatic Exchange of Information Shouldn't Leave Countries Behind - Financial Transparency Coalition

Standard for Automatic Exchange of Financial Account Information in Tax Matters: Implementation Handbook - OECD

Automatic Exchange of Information: What It Is, How It Works, Benefits, What Remains To Be Done - OECD

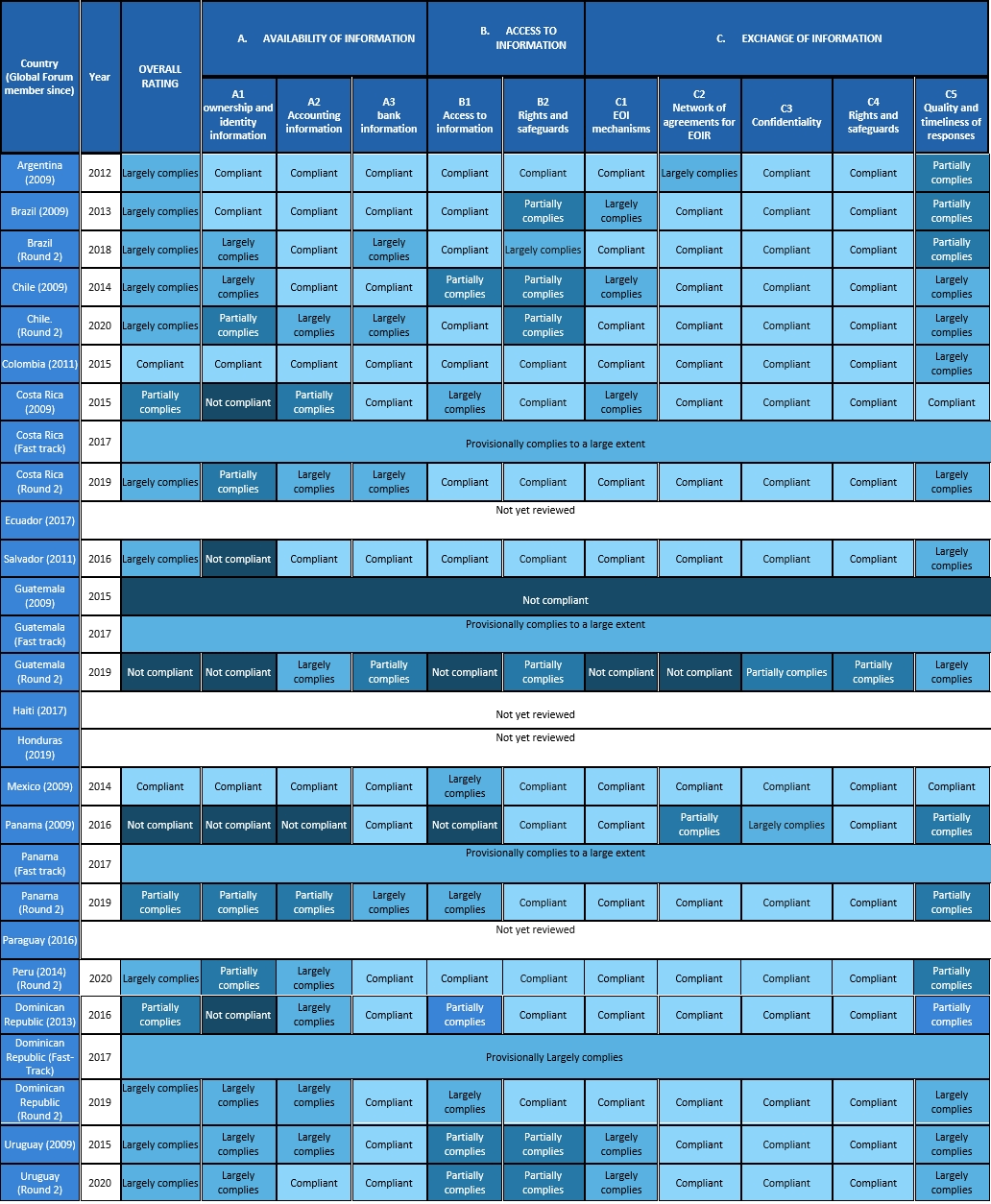

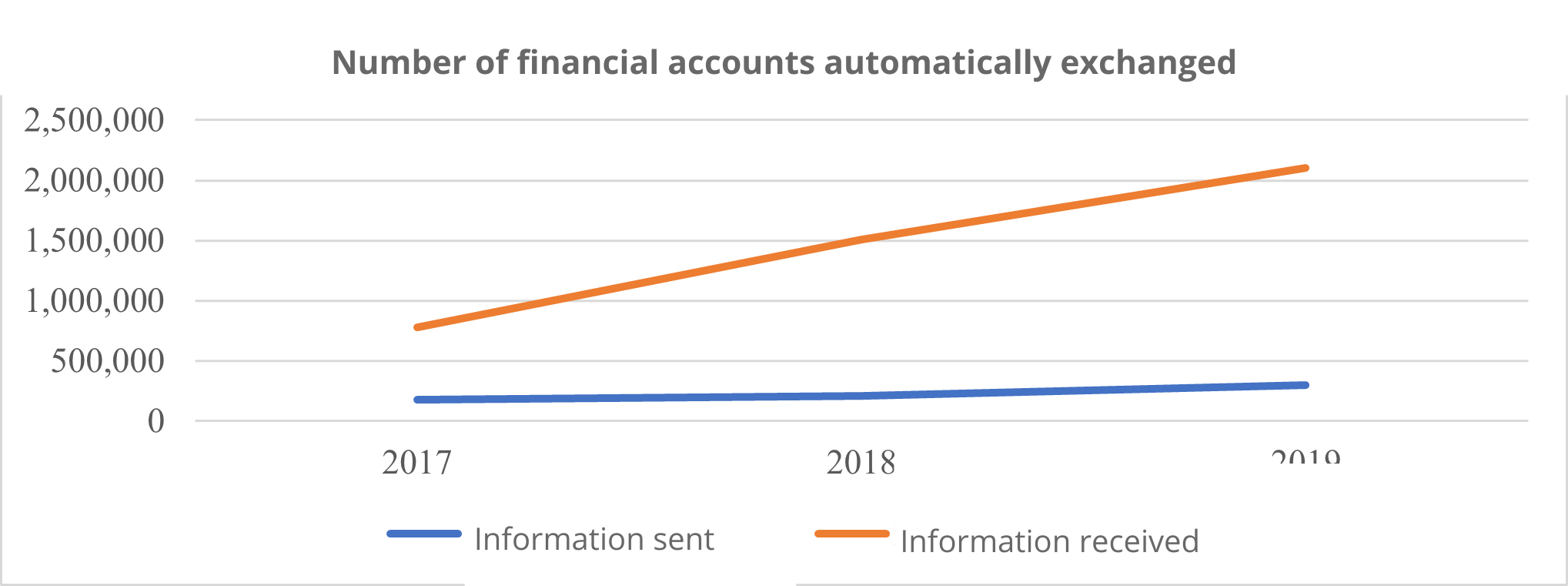

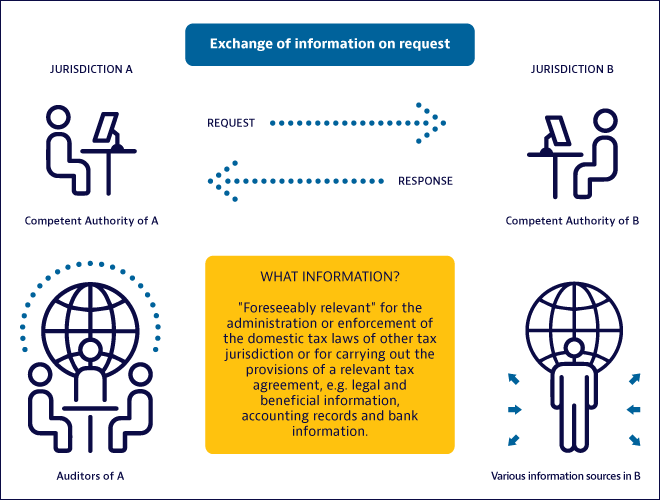

A fundamental tool for the Latin American Tax Administrations: the exchange of Tax Information | Inter-American Center of Tax Administrations